In 2021, PoS penetration of total consumer transactions stood at around 4%, or roughly $428 billion. Traditional lenders finance the vast majority, leaving around 10% of PoS transactions made via embedded finance, resulting in a loan value of around $43 billion. By 2026, this market will grow to between $80 billion and $90 billion, with negligible growth of PoS transactions overall but an increasing share becoming embedded (see Figure 8). Adyen for Platforms allows you to easily embed payments into your platform or marketplace with our out-of-the-box solution or a fully customizable setup.

- They are building payments in – developing a seamless product – rather than simply bolting them on.

- Tracking payment performance and analyzing user behaviour can provide valuable insights into customer preferences, peak transaction periods and popular payment methods.

- BaaS providers allow businesses to provide beneficial services to their clients without disclosing the involvement of a third party.

- They can now serve their users and the small to medium-sized businesses they run better.

- Everyone involved in the food chain expects the movement of money to be quick, secure, and accurate.

- It allows them to retain the payment processing fees as their own revenue, rather than handing it over to a third party.

- Companies can start by designing an embedded finance strategy that works for their needs.

They were able to spend more time focusing on growth with a persistent pain point alleviated. This is the part the customer sees – their new financial features all with your own branding and design. The licences, payment rails and BaaS are all sat underneath, how you choose to embed them is completely up to you. Using account infrastructure like virtual IBANs, businesses can create hundreds of thousands of accounts, with the ability to receive and send funds in multiple currencies.

What is embedded finance?

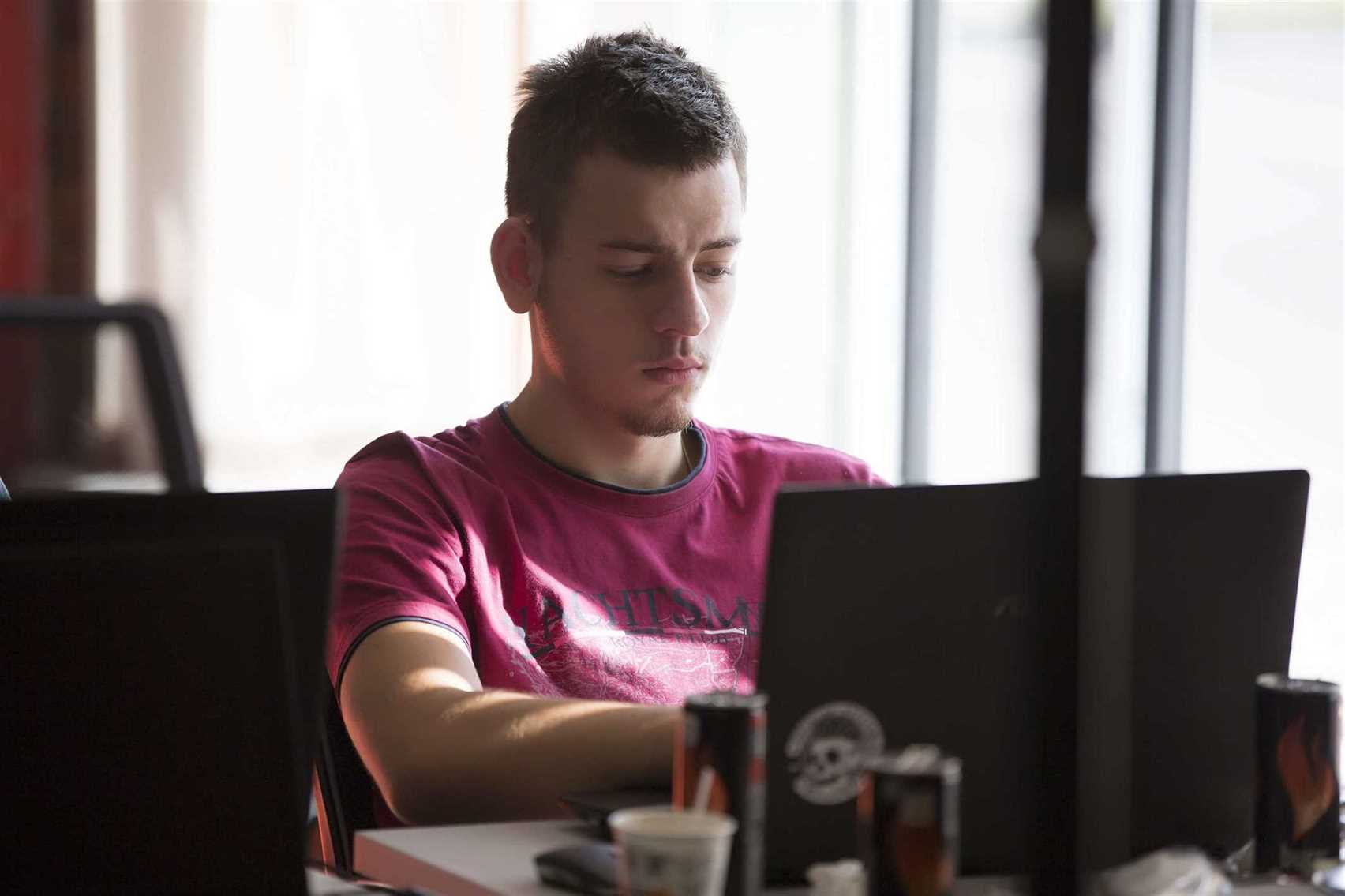

The payment process when using these apps is so seamless as to be almost invisible. This means consumers are barely aware that a transaction is taking place at all – and that’s the whole point. That last part is especially important, as Granville said he’s now seeing two basic types of non-financial entities looking for advice on using embedded finance and payments.

In just a few clicks, users on their platform can order, send, and manage new POS terminals and seamlessly collect payments from their customers online and in person. Platforms looking to evolve their product suite by offering native payments can go about it in different ways. They can choose an out-of-the-box embedded payments solution, or create a fully tailored setup. What setup your platform chooses, comes down to how much risk and responsibility you want to take on. Although some financial institutions operate with channel partners, many are accustomed to serving end customers directly.

Banks Need an Embedded Fintech Factory

These offerings are supported by an army of well-funded fintech enablers, which help platforms deliver products and services. End users increasingly prefer the convenience of using payments, lending, insurance, and other financial services embedded in their day-to-day software, rather than accessing standalone services from traditional financial institutions. Embedded financial services embedded payments companies include payment acceptance, bank accounts, lending, insurance, payroll, and more. This article focuses on embedded payment solutions, often the first rung on the embedded finance ladder for software companies interested in marketing integrated financial services to their customers. There are several methods to embed finance and banking programs into non-financial products and services.

The increasing need for simpler, quicker, and more convenient financial services, along with increasing online transactions, has fueled the platform ecosystems. Businesses, retailers, and companies are integrating it into their transaction systems to make financing more efficient. Thus, the article explains everything you need to know about embedded finance and its benefits for your business. Our own research into embedded finance found that 70% of business leaders would roll out embedded finance projects faster if there was an increased customer demand for embedded financial services. With licences and payment rails sorted, you know you can now legally accept funds in the places you want to operate in a fast and secure way. Now you can bring in Banking-as-a-Service (BaaS), enabling you to get creative with the services you offer.

What does it take to win in embedded finance?

In 2021, transaction revenue via cards was weighted toward platforms at $0.75 billion, contrasted with enablers at $0.35 billion, of which over 90% resulted from debit transactions. By 2026, we expect both levels to rise based on higher volume of embedded transactions by nonfinancial institutions. This should cause revenues to reach just over $4 billion for platforms and $1.3 billion for enablers. In the same period, we expect enabler SaaS fees to scale proportionally, growing to over $5 billion. Starting as a way for fintechs and neobanks to borrow the banking license of an established bank, embedded banking has historically been limited to prepaid or debit cards. New use cases then emerged, among gig workers and sole proprietors, and our research indicates that the market growth will continue alongside the rise of a broad set of enablers, including Galileo, Treasury Prime, Stripe, and Marqeta.

Creating a successful embedded finance strategy that meets the demands of your business is the first step. This entails assessing your digital requirements and choosing the tools you wish to integrate. The effort, time, and risk involved in creating and maintaining a native version of the service are arduous for enterprises without a BaaS provider. In addition to that, getting a regulatory certificate alone is also time-consuming and expensive for businesses. Buyers can find and add an insurance product to a transaction at the time of need, avoiding the need to speak with a broker or insurance agent.

Embedded Finance: What It Is And How To Get It Right

We anticipate rapid growth through 2026, with a fivefold increase in embedded B2B lending, bringing the loan volume to between $50 billion and $75 billion, or around 15% of the total, which will also rise slightly to around $430 billion. Embedded finance enables customers to have a new type of relationship with financial providers, giving them access to services as a by-product of the software they use and the goods they consume. While some companies will hesitate and possibly miss out on the opportunities, others will take the lead and figure out how to reap the benefits. A reported 76 percent of consumers were confused by bills from their health care providers in 2015. Now, with the health care market moving toward high deductible health plans (HDHPs), consumers are facing an increase in financial responsibility. While embedding payments isn’t necessarily for every software provider, it is a natural next step for many who are looking to grow alongside their customers as indispensable partners.

This financial transformation will continue to gain strength across nearly every sector as more companies adopt embedded finance and as consumers become more comfortable with these services. With more companies acting as financial companies, financial providers will need to become more accustomed to sharing customers with non-financial companies for services only they used to provide. This will increase competition for traditional finance companies and may result in better products and better customer service. Fintechs that offer embedded finance products are also gaining significant ground. In 2021, venture capital investments in embedded finance were triple those of 2020 (see above). In 2022, the overall embedded finance market was valued at $65.46B, and is expected to see a compounded annual growth rate of 32.2% from 2023 to 2030.

Embedded Banking

Our sizing focuses on the largest embedded finance markets today, namely payments, lending, and banking, as well as the subcategories within them. We expect the US market to more than double from $22 billion in 2021 revenue to $51 billion by 2026 across those three markets—a 19% compound annual growth rate (see Figures 3 and 4). Embedded finance began as technology to merge software and commerce business models. Today, the use cases continue to expand, from Shopify’s embedded banking offering, Shopify Balance, to a myriad of buy now, pay later (BNPL) options at online checkout. One possibility is that banking as a service and API banking become as ubiquitous as online or mobile banking, a channel that every bank must build and maintain. In that world, achieving long-term differentiation with BaaS will be difficult, so banks will continue to distinguish themselves based on products, rates, reach, and other dimensions.

This enables both financial and non-financial businesses to offer services like payments, banking, lending and insurance without becoming regulated as financial entities or building any financial infrastructure themselves. For most software programs focused on small and midsize businesses (SMBs), consumer payments are typically one of the first financial services to be embedded, given the friction those customers face in setting up payment acceptance. Most of these services have a financial core, such as banking, payments, lending, or insurance. Other categories have recently emerged, including compliance (tax, accounting), human capital management (payroll, benefits), and procurement within marketplaces. To meet the rising demand for embedded finance, financial institutions are increasingly offering banking as a service (BaaS)—bundled offerings, often white-labeled or cobranded services, that nonbanks can use to serve their customers.

What is embedded finance? 4 ways it will change fintech

While trust ratings for banks have declined at a relatively constant rate, large tech firms have gradually whittled away at the percentage of consumers giving them low marks (which hovered in the 25 percent range in recent years). With a fast-paced development arc, embedded finance is attracting significant funding from venture capital and growth equity. The space will continue to be well funded as more use cases expand the addressable market. Within embedded PoS lending, enablers and platforms should be able to increase their profits, despite shrinking margins. For B2B embedded ACH, we anticipate that platforms will see just under $4 billion of net revenue from value-added services related to ACH in 2026, compared with less than $0.5 billion for enablers.

Fiserv Unveils APIs for Embedded Finance – PYMNTS.com

Fiserv Unveils APIs for Embedded Finance.

Posted: Thu, 19 Oct 2023 02:46:58 GMT [source]